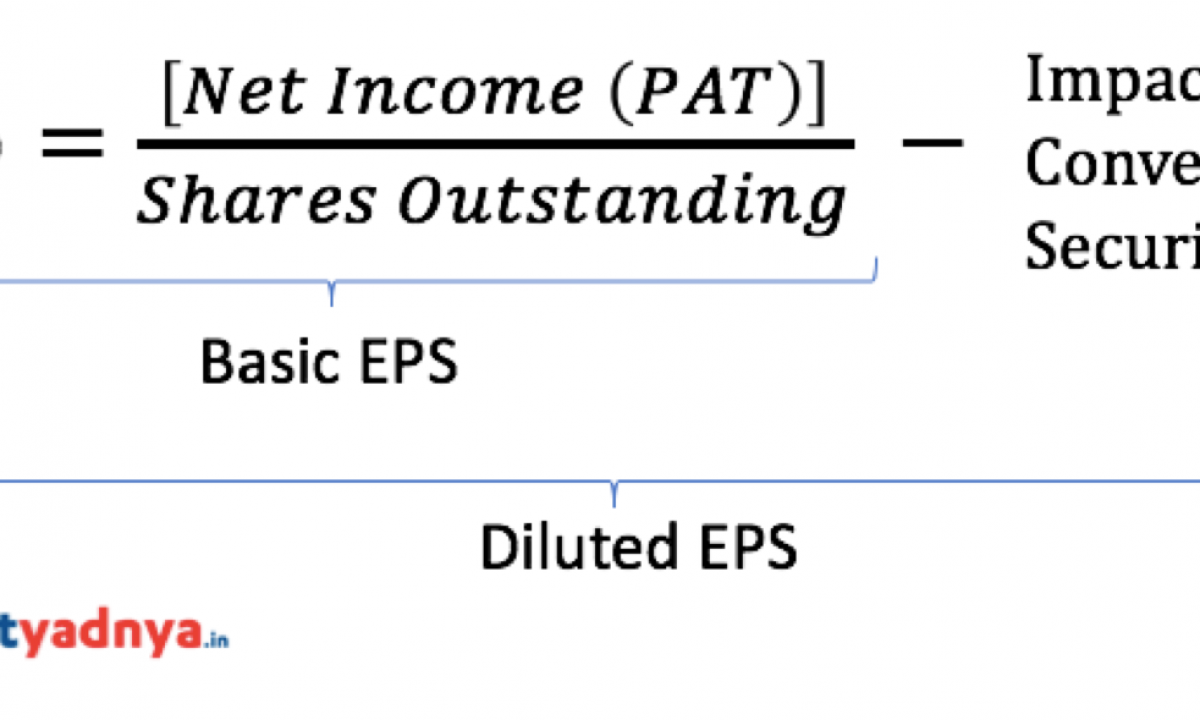

Diluted earnings per share formula

What You Should Know Diluted EPS is a performance metric used to assess a companys earnings per share EPS if all convertible securities were realized. Funds From Operations - FFO.

Diluted Eps Prepnuggets

Leverage our proprietary and industry-renowned methodology to develop and refine your strategy strengthen your teams and win new business.

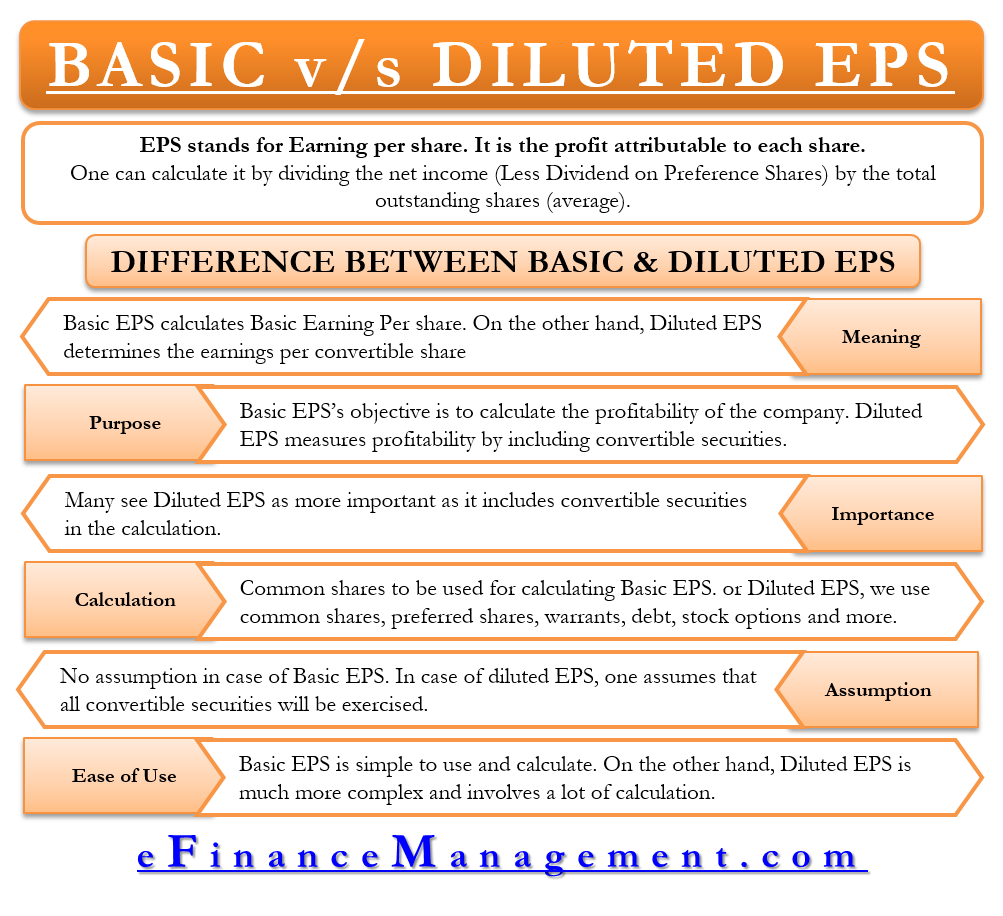

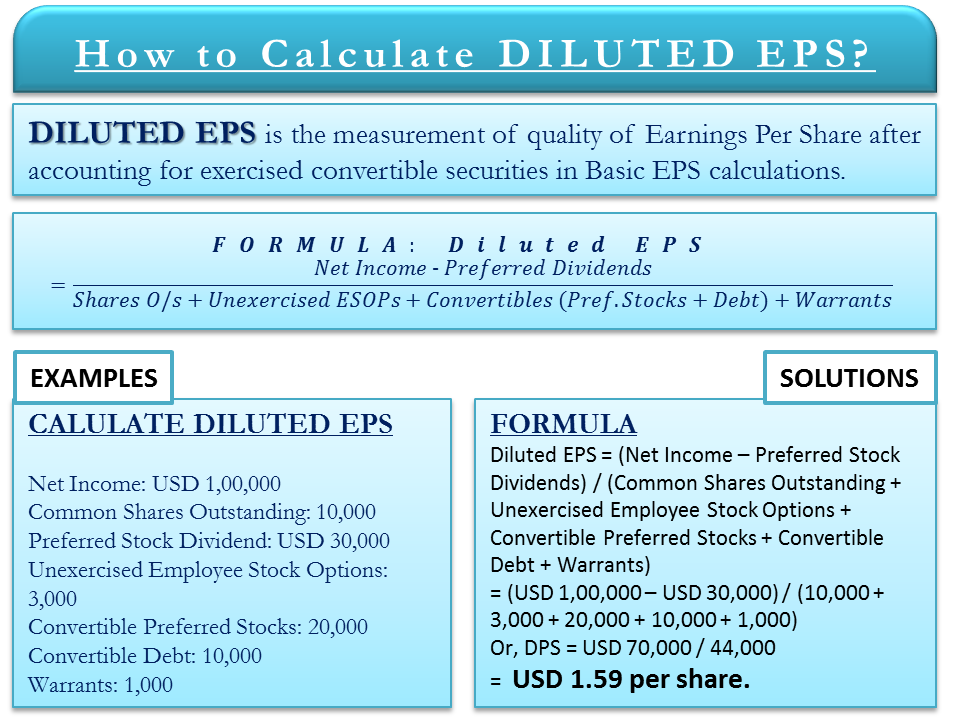

. Diluted EPS is a performance metric used to gauge the quality of a companys earnings per share EPS if all convertible securities were exercised. Diluted EPS indicates a worst case. The formula for dilution can be derived by using the following steps.

Including the impact of stock option grants and convertible bonds. Earnings per share EPS is the portion of a companys profit allocated to each outstanding share of common stock serving as a profitability indicator. The price-to-earnings PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

Earnings Per Share EPS Formula. 01754245377893705 0180408323875488 018352774771857772 016327551726043521 018412318722058663 025440356571971601 030302462588484863 036422308960837113. Diluted Earnings Per Share - Diluted EPS.

But there are other types of earnings per share the main ones being diluted EPS EPS from continuing operations and EPS excluding extraordinary items. The formula for calculating the PE ratio is as follows. The EPS calculator uses the following basic formula to calculate earnings per share.

The basic EPS is calculated by taking into account the outstanding common shares. It is calculated by. Earnings per share is a metric that can help you understand whether a companys profits are increasing or decreasing over time.

Earnings Per Share EPS vs. First we will find out the earnings per share Earnings Per Share Earnings Per Share EPS is a key financial metric that investors use to assess a companys performance and profitability before investing. Basic formula Earnings per share profit preferred dividends weighted average common shares.

What is the Diluted Earnings per Share Formula. In computing diluted EPS reporting entities may have to adjust the numerator used in the basic EPS computation subject to sequencing rules addressed in FSP 751 to make adjustments for any dividends and income or loss items associated with potentially dilutive securities that are assumed to have resulted in the issuance of common shares. Also note that stock options and restricted stock units affect the total number of shares outstanding.

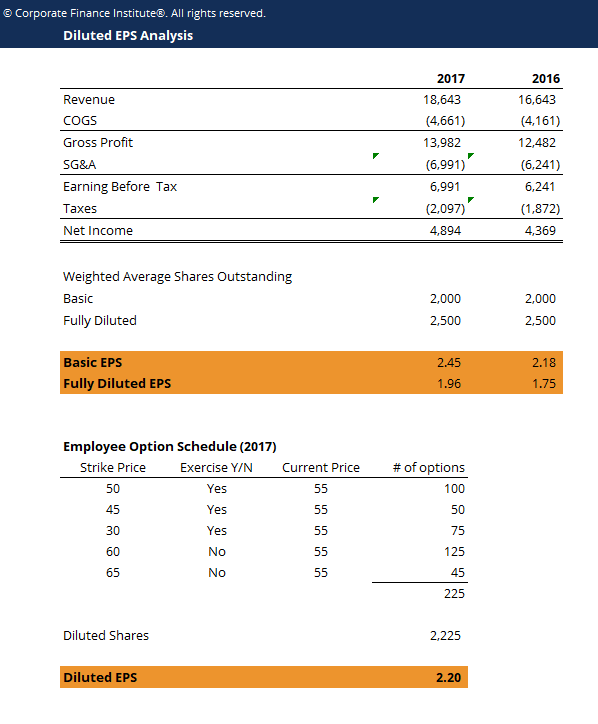

Many companies report their essential dilution elements like basic EPS diluted EPS weighted average shares outstanding and diluted weighted average sharesto analyze the effects of dilution in their Financial statements. Market value per share. Diluted earnings per share diluted EPS is a companys earnings per share calculated using fully diluted shares outstanding ie.

Funds from operations FFO refers to the figure used by real estate investment trusts REITs to define the cash flow from their operations. Diluted earnings per share is the profit per share of common stock outstanding assuming that all convertible securities were converted to common stock. Diluted EPS The basic and diluted earnings per share EPS are both indicators of a companys profitability.

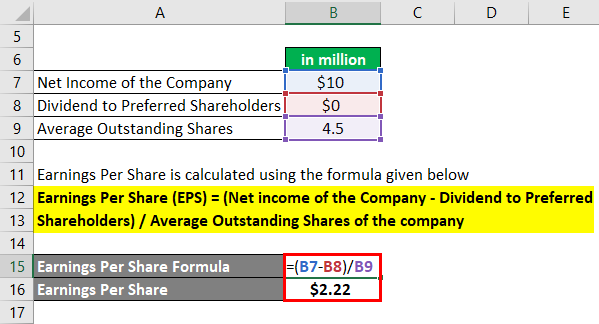

EPS is the earnings per share I is the net income of a company D is the total amount of preferred stock dividends S is the weighted average number of common shares outstanding. It is calculated by dividing total earnings or total net income by. A 5 dividend on a 25 share gives 20 percent yield.

The 4 types of earnings per share metrics are. Diluted Earnings per Share Diluted EPS. The reason for stating diluted earnings per share is so that investors can determine how the earnings per share attributable to them could be reduced if a variety of.

The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. Earnings Per Share EPS 10 0 million 45 million. Unlike the basic formula this includes.

CDSConversion of dilutive securities. To calculate this market value ratio divide the price per share by the earnings per share. Therefore the shareholding of John is expected to dilute from 1333 to 8 while the share price is expected to increase from 75 per share to 80 per share with the new issuance.

Earnings Per Share Formula Net Income Preferred DividendsWeighted Average Number of Shares Outstanding. The Diluted EPS Formula is a calculation of earnings per share after adjusting the number of shares outstanding for dilutive securities options warrants. This divides the companys annual earnings by the number of shares.

We will put it in the diluted earnings per share formula. See My Options Sign Up. In the 3-statement model this is important because it will help us forecast earnings per share EPS which is a ratio that shows how much of current-period net income.

Diluted Share Price 77 per share. More Capital Expenditure CapEx Definition Formula. Earnings Per Share EPS 222 If we compare example 1 and example 3 the buyback of the shares reduces the total common outstanding shares and improves the companys earnings per share.

Basic and Diluted EPS in Colgate. One of the last steps in building a 3-statement financial model is forecasting shares outstandingThe share count matters because it tells you how much of a company is owned by each shareholder. Earnings per share is a key number used by many investors to evaluate stock performance but it isnt as simple a figure as it appears.

The market value per share is simply the going price of the stock. WASOWeighted Average Shares Outstanding. Diluted EPS Formula net income - preferred dividends basic shares conversion of any in-the-money options warrants and other dilutions.

EPS I - D S. However diluted earnings per share include common shares and convertible securities such as options warrants and convertible debt. All information is given in the example above.

Price to Earnings Ratio PE Share Price Earnings Per Share EPS To account for the fact that a company couldve issued potentially dilutive securities in the past the diluted share count should be used otherwise the EPS figure is likely to be overstated.

Calculation Of Diluted Eps Convertible Preferred Stock Finance Train

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-04-830c75927d71433996acc6bc0ca55e06.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

What Is Earning Per Share Eps Basic Vs Diluted Eps Yadnya Investment Academy

What Is Dilutive Vs Antidilutive For Eps Universal Cpa Review

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Simplifying Eps

Dilutive Securities And Earnings Per Share Learning Objectives At The End Of The Presentation You Should Learn How To 1 1 Compute Earnings Per Share Ppt Download

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Share Dilution Meaning Calculation Example Diluted Eps Protection

Basic Vs Diluted Eps All You Need To Know

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

How To Calculate Diluted Eps Formula Example Importance Efm

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Earnings Per Share Formula Eps Calculator With Examples

Diluted Eps Formula Example Calculate Diluted Earnings Per Share

Calculating Diluted Earnings Per Share